The Best Guide To Pvm Accounting

The Best Guide To Pvm Accounting

Blog Article

How Pvm Accounting can Save You Time, Stress, and Money.

Table of ContentsFacts About Pvm Accounting RevealedFacts About Pvm Accounting UncoveredThings about Pvm AccountingA Biased View of Pvm AccountingSome Known Details About Pvm Accounting What Does Pvm Accounting Do?The Greatest Guide To Pvm Accounting

In terms of a business's total method, the CFO is liable for directing the business to satisfy economic goals. A few of these methods can involve the business being acquired or purchases going onward. $133,448 per year or $64.16 per hour. $20m+ in annual income Service providers have developing needs for workplace supervisors, controllers, bookkeepers and CFOs.

As a business expands, accountants can maximize more personnel for other business tasks. This could eventually result in enhanced oversight, better accuracy, and much better compliance. With more sources following the trail of cash, a specialist is a lot more likely to make money accurately and in a timely manner. As a building and construction firm expands, it will certainly demand the help of a permanent financial personnel that's managed by a controller or a CFO to take care of the business's financial resources.

The smart Trick of Pvm Accounting That Nobody is Talking About

While big services may have full time monetary support groups, small-to-mid-sized services can work with part-time accountants, accountants, or financial consultants as needed. Was this write-up handy?

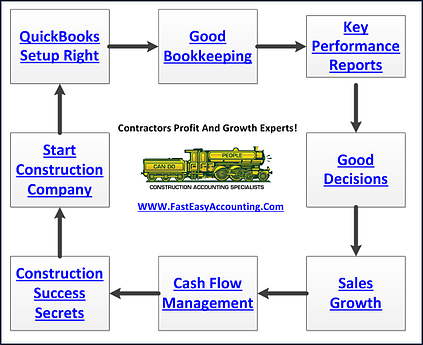

As the building and construction sector remains to flourish, businesses in this field should preserve strong financial administration. Effective accountancy practices can make a considerable distinction in the success and development of construction companies. Let's discover 5 necessary bookkeeping techniques customized particularly for the building and construction sector. By implementing these methods, construction companies can enhance their monetary stability, streamline operations, and make educated choices - construction bookkeeping.

Thorough price quotes and budget plans are the foundation of construction task management. They assist guide the job towards timely and rewarding completion while safeguarding the passions of all stakeholders involved. The vital inputs for project price estimation and budget are labor, materials, devices, and overhead costs. This is usually among the greatest expenses in construction tasks.

The Best Strategy To Use For Pvm Accounting

An accurate evaluation of products required for a task will certainly help make sure the needed materials are purchased in a timely way and in the appropriate amount. An error right here can bring about waste or hold-ups due to material lack. For most construction projects, devices is required, whether it is acquired or leased.

Correct tools estimation will certainly aid ensure the ideal equipment is offered at the appropriate time, conserving time and cash. Do not neglect to account for overhead expenses when estimating project costs. Direct overhead costs are details to a project and may include temporary leasings, energies, secure fencing, and water products. Indirect overhead expenses are day-to-day costs of running your company, such as rental fee, administrative incomes, energies, taxes, devaluation, and advertising.

One other variable that plays into whether a task succeeds is an accurate price quote of when the task will certainly be finished and the associated timeline. This price quote helps make sure that a job can be finished within the designated time and resources. Without it, a job might run out of funds prior to conclusion, causing potential job interruptions or desertion.

Our Pvm Accounting PDFs

Precise work setting you back can he said help you do the following: Recognize the productivity (or do not have thereof) of each project. As work costing breaks down each input into a job, you can track productivity separately.

By identifying these products while the task is being completed, you prevent shocks at the end of the task and can address (and ideally prevent) them in future tasks. An additional device to help track work is a work-in-progress (WIP) routine. A WIP timetable can be finished monthly, quarterly, semi-annually, or every year, and includes task information such as agreement worth, costs incurred to date, overall approximated costs, and total task payments.

An Unbiased View of Pvm Accounting

Budgeting and Projecting Tools Advanced software program uses budgeting and forecasting abilities, allowing building and construction business to intend future jobs more accurately and handle their financial resources proactively. Paper Monitoring Construction tasks involve a whole lot of paperwork.

Boosted Supplier and Subcontractor Monitoring The software program can track and manage settlements to vendors and subcontractors, making sure timely settlements and maintaining good connections. Tax Obligation Preparation and Filing Audit software can help in tax obligation preparation and declaring, making certain that all relevant economic activities are properly reported and taxes are filed on time.

Pvm Accounting for Beginners

Our client is a growing growth and construction firm with head office in Denver, Colorado. With several active building and construction tasks in Colorado, we are searching for an Accounting Aide to join our team. We are looking for a full time Accountancy Assistant that will be accountable for supplying functional support to the Controller.

Receive and evaluate everyday billings, subcontracts, change orders, purchase orders, check demands, and/or various other relevant documents for efficiency and conformity with monetary policies, treatments, spending plan, and contractual needs. Accurate handling of accounts payable. Get in billings, authorized draws, order, etc. Update regular monthly analysis and prepares budget plan trend reports for building and construction projects.

Not known Incorrect Statements About Pvm Accounting

In this guide, we'll look into different elements of building accounting, its importance, the requirement tools utilized around, and its function in building and construction tasks - https://www.easel.ly/browserEasel/14478975. From economic control and cost estimating to capital administration, check out exactly how audit can benefit construction jobs of all scales. Construction accountancy describes the specific system and processes used to track monetary details and make tactical decisions for construction companies

Report this page